Absorption Costing Impacts in Time Element Claims

What is Absorption Costing?

Absorption costing, or full costing, is a method for accumulating and apportioning costs (variable and fixed) associated with the production process. Under absorption costing, expenses are assigned on a per unit or per project basis. This method is commonly used by manufacturing entities. It is the linking of all production costs to the unit produced or project completed. It allows the manufacturer to assign direct variable costs (labor and materials), variable manufacturing overhead (VMOH) and fixed manufacturing overhead (FMOH) costs to each unit of production or each project. Overhead costs get assigned to inventory / projects based on some sharing mechanism basis, usually direct labor hours, direct machine hours, or units produced. The assignment of these costs, variable and fixed, allows them to be capitalized, making them an asset until they are expensed (in the form of cost of goods sold) when a sale is made. Costs assigned to inventory or projects are referred to as product / project costs.

Importantly, absorption costing does not recognize the fixed product costs as expenses until that inventory is actually sold or the project is completed and the revenue is recorded, at which time the expense is charged to cost of goods sold. For example, fixed production salaries incurred in January related to product sold in March are capitalized as an asset (inventory) in January and expensed March.

Period costs represent non-manufacturing costs, including selling and general administrative expenses. Period costs are excluded from the calculation altogether (absorption calculation) as they not part of the manufacturing process and are not subject to capitalization.

Why Absorption Accounting Exists?

Companies prepare financial statements using absorption accounting to comply with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This basis for costing establishes a common model for reporting entities, allowing stakeholders to make comparisons across many companies. Absorption costing may also aid a company in calculating the overall cost of a product or project, so that it may use the total cost as a data point when making determinations about the price of a product or project.

Absorption Accounting in a Business Interruption Context

Absorption accounting is useful in certain contexts. However, as mentioned above, the costs incurred are not reported until the product is sold. The period in which a product is “sold” is often different than the manufacturing period. In the context of a business interruption loss, this creates several measurement and expectation issues and challenges in the claims process.

An interruption of an insured’s manufacturing process may not affect the long-term revenue stream of an insured if the product or project timeline can be made up, or if the revenue is simply deferred until a later date. If an insured maintains sufficient stock or can work with its customer within the confines of the operative contract (if it is a project-based work), the production downtime may result in no actual loss of revenue. This frequently occurs when the insured is locked into a longer-term contract that is unlikely to be materially affected or modified. Additionally, if an insured maintains sufficient inventory levels, it may continue to sell products out of inventory or make up the lost production time at some other point outside of the loss period, thereby mitigating or eliminating a loss of revenue.

In the context of a long-term contract, where an insured is contracted by its customer to produce a component part that requires staged deliverables every 6 or 12 months, the interruption in this process does not necessarily reduce revenue. However, the accounting immediately following an event is modified even if there is no loss in the form of revenue.

The fixed costs associated with producing the component part are still incurred, with the absorption of the cost being suspended until production can resume. In other words, the fixed cost is not capitalized and moved to the balance sheet and remains an unassignable expense. When production resumes, the capitalization of fixed costs resumes. The end result is the postponement or suspension in the absorption of fixed costs, which can lead to orphaned fixed project costs. From an insurer’s perspective, the fixed costs are unaffected by the loss. However, instead of the cost being capitalized to inventory and being removed as an expense, they remain as an expense on the profit and loss statement. The actual fixed costs remain unchanged during both the short and long term. The fixed costs that are idle ultimately may get expensed or assigned to a non-chargeable project during the interruption period or to the delayed project at a later date, creating the appearance of extra expense or a project that is less profitable.

For example, a 6 month project with budgeted fixed overhead costs of $1,500,000 experiences a 1 month interruption. The planned monthly $250,000 in fixed overhead will still be incurred by its nature as a fixed expense, but may not be assigned to inventory or the project during the interruption period. The insured may choose to assign these inventory costs to a period cost account that is expensed immediately or suspend and delay the assignment of these expenses during the idle period, resuming the assignment once production resumes. When production resumes, the project may still absorb $250,000 per month in overhead for six months. However, the insured’s perspective will be that the project (or the insured’s operation) will have an additional month’s worth of fixed overhead that it either could not assign to the project (orphaned) or is assigned to the project as a cost overrun. This is typically presented as an additional project cost by the insured, but is actually a planned fixed cost, that is fundamentally unchanged by the loss. The only change is that the cost is not absorbed by production, an accounting entry which does not impact the overall cost structure. The postponed assignment of these costs does not result in an extra cost when you consider the nature of expenses typically included within fixed overhead.

Fixed overhead is typically comprised of leasing costs for equipment, rent, depreciation, salaries, and other fixed costs, which remain unchanged whether the insured completes the project in 6, 8 or 12 months. These are costs that would have been incurred, with and without the loss. They may be presented as excess project costs, but are more likely unassigned fixed costs.

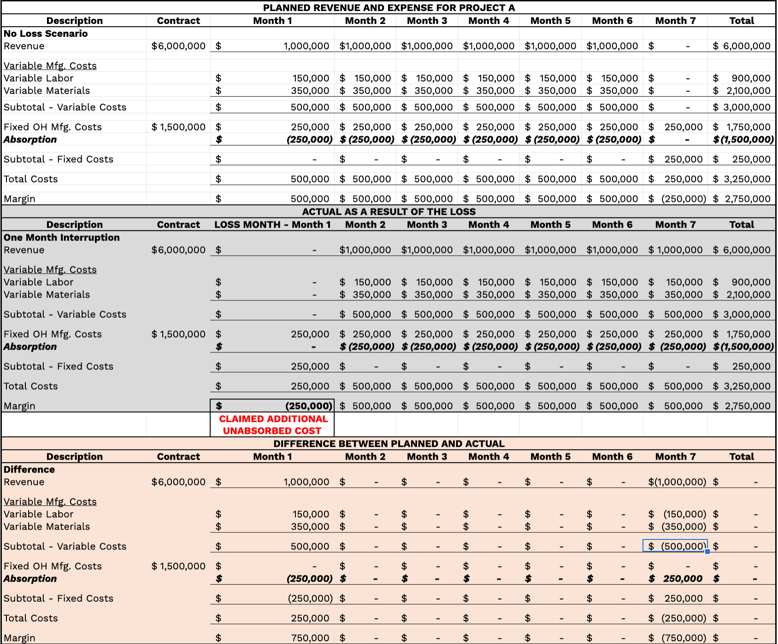

Please refer to the Illustration in Table 1, which outlines the planned v. actual costs of a project, with the impact of the absorption entry. A few salient points are noted below:

- Month 1 shows fixed costs as unabsorbed. These costs are normally converted to assets and are removed from the profit and loss statement until the inventory or project is sold or completed. In this instance, the “absorption” accounting treatment does not occur as planned in month 1 as the result of the loss. Importantly, the cost is still incurred and would have been incurred with or without the impacted project. The loss affects the accounting treatment only and not the actual expense itself. The project may absorb more of that fixed cost in the form of an additional month, but there is no additional spend from the insured as a result.

- Month 7 includes the back-end revenue and make-up margin.

- Month 7 also includes the planned v. actual fixed overhead costs, highlighting that there are no differences between the planned and actual fixed costs.

The accounting treatment suggests that the fixed cost is extra, however, it is clear that the fixed costs, by their very nature are normal, unchanged, and unaffected by the loss and are incurred with the passage of time. The only impact is that the fixed cost is not absorbed by the inventory or project and transferred to the balance sheet. This cost remains on the profit and loss statement instead of being moved to the balance sheet as planned.

Download article here.

This article was co-authored by Christian Fox, CPA, Vice President in our Investigative Accounting and Litigation Support Group. Since joining Meaden & Moore in 1999, Christian has focused his career exclusively on servicing the insurance industry and legal profession. His experience includes work on commercial insurance claims and litigation support involving property damage, business interruption, extra expenses, and loss of profits in a variety of industries.

TABLE 1

Patrick Kelleher, CPA, CFF, has nearly two decades of experience working in the area of forensic and investigative accounting field. He has extensive experience in the commercial insurance claims area, evaluating claims of financial damages, including business income, property and fidelity matters ranging from $50,000 to $150 million in damages.